And the debt collection software that automates the process

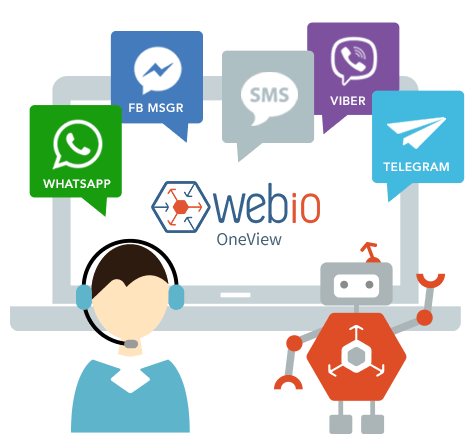

AI chatbots interact with customers in a useful and natural way to swiftly resolve issues without unnecessary agent involvement.

Speed up the debt recovery process with digital engagement and automated workflows that take care of repetitive tasks.

Integrate with essential solutions, e.g. financial software and CRMs, to provide accurate data and real-time updates.

Debt recovery software can be encoded to make sure a company remains in compliance with a country's particular regulations and legal frameworks, and ensures adherence to industry-specific guidelines and statutory requirements.

Debt collections software also provides essential features such as automated debt tracking, integrated communication channels, and customisable debt collection workflows.

With its advanced reporting capabilities and data analytics tools, debt recovery software empowers businesses to make informed decisions, manage debt collection strategies, and improve overall financial performance.

By automating customer engagement with conversational AI chatbots, fewer agent resources are needed and agents are also more productive.

Debt collection services in the UK play a key role in helping businesses recover outstanding debts, while other organisations help individuals in trouble to take control of their finances. Debt recovery services provide professional and legal advice, help with negotiation and advise on ethics and regulations.

Several debt help services are available in the UK to help individuals and businesses to manage their debts and find solutions. These services aim to provide guidance, support, and resources to help people regain control of their finances, and include: debt counselling and advisory services (e.g. StepChange Debt Charity, National Debtline, and Citizens Advice); Debt Management Plans (DMPs); Individual Voluntary Arrangements (IVAs); Debt Relief Orders (DROs); and Bankruptcy and Insolvency Services

The debt recovery process in the UK may vary depending on the particular circumstances, such as the nature of the debt and the amount owed. Throughout the process, debt recovery software can make these activities faster, safer and more effective. Briefly, this is how the process works:

Initial Contact: Notify the customer of their outstanding debt through a phone call, letter, text message or email. At this stage, the customer has a chance to pay or make a payment arrangement.

Follow-up Communication: If the customer continues to not pay or respond, the creditor or debt collection agency (DCA) will make further attempts to engage with them and find a resolution.

Formal Demand and Legal Action: If there is still no positive response, the creditor or DCA may issue a formal demand letter. This letter serves as a final notice, outlining the consequences of non-payment and providing a final opportunity to settle the debt before legal action is set in motion.

Court Proceedings: If the debtor fails to respond or make arrangements after the formal demand, the creditor or DCA may initiate legal action by filing a claim in court.

Judgment and Enforcement: If the court finds in favour of the creditor, a judgment will be issued against the debtor, confirming the debt owed. Creditors can then use various emthods to recover the debt, such as havign bailiffs seize assets, attach earnings, issue charging orders, or in serious cases, pursue bankrupcy/insolvency proceeedings against debtors.

During the debt recovery process, both creditors and debtors have rights and responsibilities that must be upheld.

Engaging professional debt recovery services specifically tailored to businesses can prove invaluable in recovering the debts that could sink a company if they’re not collected.

Many times, small businesses face greater challenges when it comes to recovering outstanding debts due to limited resources and time constraints. Fortunately, there are debt recovery companies that focus on helping small businesses. These companies know the specific needs of small businesses and offer targeted solutions.

Consumer debt recovery is the process of collecting outstanding debts owed by individuals to businesses. In some cases, debt recovery companies make consumer debt their specialisation and they understand the unique dynamics of this type of debt.

Debt recovery companies specialise in helping businesses to recover outstanding debts while ensuring compliance with legal and regulatory requirements.

If you need advice on how to improve your customer engagement talk to us. You will love the Webio experience. We promise.

Chat to one of our experts to learn more