Future of Technology and Open Banking at Collections Think Tank

The Credit and Collections Technology Think Tank is back live and in person.

A conference with a difference, the focus is on panel discussions that discuss thematic lending and collections issues with the day focused on problem-solving and how companies can utilise people and

technology innovations effectively.

The Think Tank's primary focus is to create an engaging environment with the aim of enabling all attendees to learn about forthcoming technological innovations in the credit and debt collections arena.

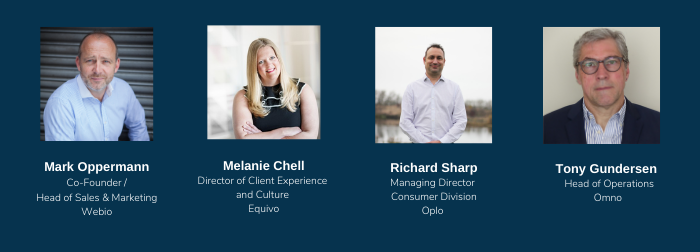

With four panel sessions, we are delighted that Mark Oppermann from Webio will join session 4, ' The Future of Technology and Open banking' panel where they will discuss the importance of business transformation and creating the right mix between people and technology, the future for lending and collections and creating an end-to-end strategy, and what the potential negative impacts of technology are.

Also joining the panel are Richard Sharp, Managing Director Consumer Division at Oplo, Tony Gundersen, Head of Operations at Onmo, and Melanie Chell, Director of Client Experience and Culture at Equivo.

Here is a look at the other sessions on the day:

Panel 1: Credit and collection landscape

The industry view on assessing the credit and collections challenges. How can the lending, credit and collections sectors work closer to enhance the best customer outcome?

Kevin Still, Director at Debt Managers Standards Association (DEMSA), Russell Hamblin-Boone, Chief Executive Officer at The Civil Enforcements Association (CIVEA), Chris Leslie, Chief Executive Officer at the Credit Services Association (CSA), and Anna Roughley Head of Insight at Lending Standards Board (LSB).

Panel 2: What has the pandemic done to risk appetite?

Assessing lending and collections risk.

Paul Smith, Chief Executive Officer at Morses Club, Paul Chong, Co-Founder at Ophelos, Frank Brown Practice Lead: Head of Risk and Transformation at Bovil, Peter Gent, Sales Director at CRS.

Panel 3: Affordability and Vulnerable customers

Can data play a bigger role? The importance of the customer journey from the start of the lending/credit cycle through to collections. Can the online lending and collections self-service models work?

Sonya Schofield, Head of Vulnerable Customer Strategy at GAIN Credit, Frank Sherlock, Vice President International at CallMiner, Guy Statter, Head of Software Sales at Qualco.

The event runs from 9:30 am to 3:40 pm and is followed by the gala dinner for the Credit Technology Awards.

You can find out all the

details here.