AI-driven personalised communication

Reach a wide customer base yet connect personally with interactive dialogues.

Increase agent capacity to handle multiple conversations with asynchronous messaging.

Conversational AI technology allows bots to communicate relationally.

Using conversational AI for customer engagement puts the customer at the centre by personalising each interaction. The automated conversations feel natural and it is important to keep the tone relational, especially if a customer is in a vulnerable state.

If a person feels understood and not pressured, they are more likely to trust you and respond positively. Good customer experiences mean happier customers which translates into a healthy bottom-line.

Conversational AI platforms are taking customer engagement to the next level. At their core, automated chatbots are built around Natural Language Processing and continuous Machine Learning to hold humanlike conversations. Taking a blended approach allows live agents to step in if the bot can’t resolve an issue.

Over 70% of conversations can be automated with conversational AI, which bumps up the volume of customer conversations a company can hold each day – live agents simply cannot cope with the same number at a given time.

Customers respond better if they feel understood and are more than just a faceless account number to a company. Conversational engagement is interactive and a person can ask questions rather than just receive heartless messages. Likewise, the company can ask questions in return and all in real-time. Also, the way you text is as important as what you say as an empathetic tone goes a long way.

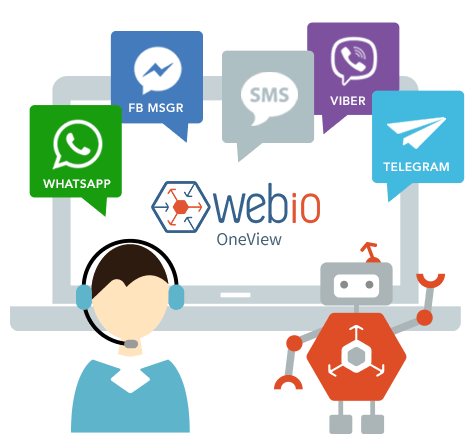

Customers also respond better if they are contacted on the channels they feel familiar with. SMS and WhatsApp have high open rates of over 90% with email having just 20% on average.

Guided by AI chatbots, customers can quickly take care of the more straightforward activities. This is convenient for both the company and the customer. In fact, customers now expect this level of functionality and prefer it to waiting for a live agent to help them.

Integration with an organisation's own data and connections with an API to a third-party bring immediate, hassle-free customer service that is available 24/7. Integration also ensures that information is readily accessible and accurate.

If you need advice on how to improve your customer engagement talk to us. You will love the Webio experience. We promise.

START A CONVERSATION