Engaging Conversations, Smarter Interactions

Chatbots lower the barriers to talking about finances as they remove the awkwardness factor.

Customers respond better to digital conversational messaging than to either telephone calls or emails.

Users love the convenience of conversational AI guided self-service for straightforward tasks.

Conversational AI uses automated chatbots to have two-way interactions with customers using human-like language. They use large or custom language models and natural language processing to understand the intent of what someone is saying - beyond mere keywords and logic rules - and then they respond accordingly.

AI chatbots can also pick out ENTITIES (like dates), INTENTS (e.g. vulnerabilities, payment) and PROPENSITIES (the likely outcome) and can use that information to efficiently resolve a query.

The bots can also tap into real-time data using API integration to personalise the conversation.

Companies who were getting about 3% engagement rates with dialers are now achieving 45% and even 89% engagement rates when using Webio AI and automation. This effectiveness goes further with a notable impact on collections, with an average of 10% increase in debt recovered.

Using conversational AI chatbots, Webio clients see automation levels bump up passed 75%. Clients have also seen agents go from closing 50-70 conversations per day to 380-420. This means businesses can do more with fewer resources, and be available 24/7.

When using conversational AI in debt collection, the metrics all go in the right direction: response rates go up, operational costs go down, agent handling times go down and collections go up.

When AI is used as a digital assistant/copilot, agents can excel at their job. The AI chatbots can take care of over 70% of all customer conversations and can do so at scale without losing the personal touch. Taking a blended approach with AI automation and live agents allows you to have fewer calls but more conversations

In sensitive customer conversations, allowing generic generative AI chatbots like ChatGPT to have full control is dangerous as they can go rogue and fabricate wild responses. Instead, a custom language model should be used which is specifically built for an industry, e.g. credit and collections in Webio's case. This ensures security and compliance.

Generative AI is useful for writing conversation summaries and providing suggested responses that agents select. It is also useful in training agents in simulated conversations.

Conversational AI platforms allow you to include transactions within the flow of the dialogue.

Examples include payments and Income & Expenditure Forms.

Another useful functions is uploading documents and images, such as bank statements and photos of passports for ID. The AI can 'read' these and extract the information needed.

A customer’s experience when interacting with you will determine whether they do business with you again, so help them by making it easy for them. Such things as using their preferred digital massaging channel, being guided along the process or handed to an agent if needs be, all add up to a positive response.

Also, customers like being in control so give them options to resolving any issues. In the end, using conversational AI for customer engagement makes a huge difference to the impression you leave and how well the customer journey ends.

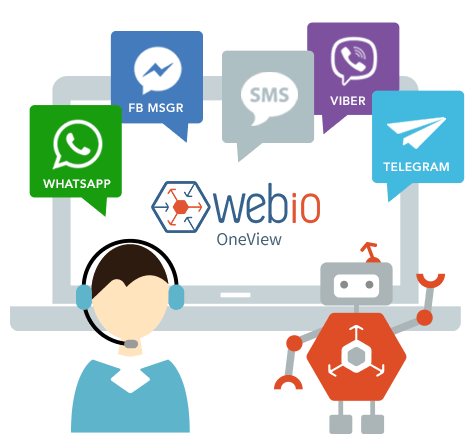

If you need to improve your customer engagement, talk to us and we'll show you how AI automation via digital messaging apps works. You will love the Webio experience. We promise.

Talk to us about Conversational AI